China Stimulus Measures Help Soften Economic Slowdown

June 01 2016 - 12:10AM

Dow Jones News

BEIJING—An official measure of China's manufacturing sector held

steady in May while a private gauge edged down slightly, as

aggressive monetary stimulus in the first quarter cushioned the

downdraft in the world's second-largest economy.

The National Bureau of Statistics said Wednesday that China's

official purchasing managers index for manufacturing remained at

50.1 last month, the same level as in April and the third

consecutive month the index kept above 50, the line separating

expansion from contraction. The May PMI beat a median forecast of

49.9 by 11 economists polled by The Wall Street Journal.

The competing private Caixin manufacturing PMI edged down to

49.2 in May from 49.4 in April, the 15th straight month that index

has remained in contractionary territory, Caixin Media Co. and

research firm Markit said Wednesday. Caixin's index better reflects

the outlook for smaller private manufacturers while the official

PMI gives more weight to larger state-owned companies, economists

say.

China's official nonmanufacturing PMI, also released Wednesday,

fell to 53.1 from 53.5 in April.

Economists said the latest data suggest that Beijing's

frontloading of monetary and fiscal stimulus early this year should

make it easier for China to reach its 2016 growth target of at

least 6.5% this year.

"Growth has stabilized and policy will remain accommodative,"

said Standard Chartered Bank Ltd. economist Ding Shuang. "So 6.5%

is still a very serious target for the government. What people

should be worried about is the cost of maintaining that

growth."

One cost in particular, economists said, is rising debt as

Beijing expands credit faster than the rate of growth to bolster

economic stability. Banks lent a record 4.67 trillion yuan ($709

billion) in the first quarter, exceeding the amount released at the

depth of the global financial crisis even as growth decelerated in

the first quarter to 6.7%, its slowest pace since 2009.

"There are a lot of zombie companies and zombie loans," said

J.P. Morgan Chase & Co. economist Zhu Haibin, referring to

loss-making entities that are kept afloat. "If they don't write

that debt off, they stay on the balance sheet."

China's total debt, led by corporate liability, has increased to

260% of gross domestic product in 2015 from 160% in 2007,

economists estimate. Interest on China's mounting corporate debt

will take up around 60% of industrial profits for Chinese companies

this year, according to estimates by investment bank North Square

Blue Oak.

Wednesday's data come as China's industrial sector faces

continued headwinds as electricity and cement production weakens.

The statistics bureau said the manufacturing subindex measuring new

orders dropped to 50.7 in May from 51.0 in April, exports held

steady at 50.0 while the production subindex improved slightly to

52.3 from 52.2.

Xinxing Wood Processing Factory., a furniture maker based in Cao

County in eastern China's Shandong province, said it had 200 orders

last month compared with 500 orders a year earlier. "In the next

several months, I don't think things will improve much," said Meng

Fanxin, the company's general manager. "The domestic market is very

competitive."

Labor costs for the company have increased to over 65 yuan a

day, a 10% rise from recent levels, squeezing its profit margin to

10% from 15%, Mr. Meng said. As a result, the company may have to

lay off some of its 40 employees. "We are planning on buying more

advanced equipment so we won't need as many workers," he said. "A

job that used to take three workers can be done by one worker in

the same amount of time."

Economists said a stabilizing economy could give the government

some breathing room to take more aggressive structural reform,

including cuts in excess capacity and fostering new sources of

growth. China has pledged to reduce capacity in the steel and coal

sectors by around 10% in the next few years and cut a combined 1.8

million jobs, although industry analysts say this is far less than

what is needed to address the excess capacity in these

industries.

Liyan Qi contributed to this article.

Write to Mark Magnier at mark.magnier@wsj.com

(END) Dow Jones Newswires

May 31, 2016 23:55 ET (03:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

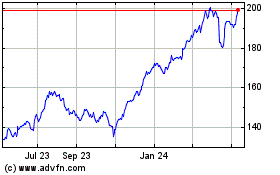

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

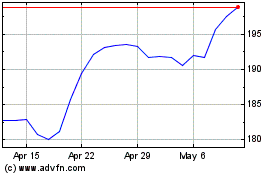

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024