Foxtons Profit Slumps as London Housing Market Cools--Update

July 29 2016 - 7:50AM

Dow Jones News

By Art Patnaude and Tapan Panchal

LONDON--A weaker London housing market has pushed down profits

at Foxtons Group PLC, one of the U.K. capital's biggest property

brokers.

The London-focused real-estate broker on Friday reported pretax

profit in the first half of 2016 of GBP10.5 million ($13.8

million), 42% lower than the same period last year. The firm blamed

uncertainty created by Britain's referendum over its European Union

membership in June.

Foxtons shares fell 8.5% Friday to 113.5 pence, down 53% from 12

months ago. The company dropped out of the FTSE 250 index in

December because of deep share-price declines.

The decision to leave the EU will continue to hit profits

through the rest of the year, the firm said. U.K. property brokers

Countrywide PLC and LSL Property Services have also said their 2016

profits would be lower than last year due to Britain's vote to

leave the EU.

The U.K. housing market had cooled this year ahead of the

referendum, with buyers and sellers pausing amid uncertainty over

the outcome. The weakness was most acute in central London.

The leave vote has created fresh uncertainty, with the U.K. now

needing to negotiate the terms of its exit, a process that could

take years.

Amid a lack of clarity, "we do not expect London residential

property sales markets to show signs of recovery before the end of

the year," said Nic Budden, chief executive at Foxtons.

The high-end housing market in central London, where Foxtons has

historically focused its business, has been cooling since prices

peaked in the summer of 2014. Government tax hikes and years of

strong price gains turned off foreign investors that were also

contending with market volatility and low oil prices.

To combat the slowdown, last autumn Foxtons announced plans to

ramp up its business in the suburbs, where it would open new

offices.

The company is now reviewing those growth plans, "and may slow

the pace of expansion in response to market conditions," Mr. Budden

said.

"Expanding in a contracting market is proving even too difficult

for Foxtons," said Anthony Codling, equity analyst at Jefferies

International, in a note to investors.

The company maintained its interim dividend at 1.67 pence per

share and decided not to pay a special dividend. In the first half

of 2015, Foxtons declared a special dividend of 3.10 pence per

share.

The weak results were largely expected, but the "lower dividend

and some greater than expected lettings weakness is an incremental

negative," said Heidi Richardson, analyst at Swiss lender UBS AG in

a note.

Write to Art Patnaude at art.patnaude@wsj.com and Tapan Panchal

at Tapan.Panchal@wsj.com

(END) Dow Jones Newswires

July 29, 2016 07:35 ET (11:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

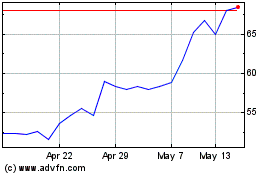

Foxtons (LSE:FOXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

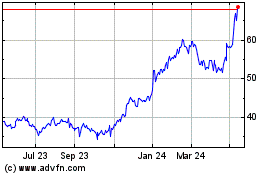

Foxtons (LSE:FOXT)

Historical Stock Chart

From Apr 2023 to Apr 2024