Report of Foreign Issuer (6-k)

October 28 2016 - 7:45AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Date: October 28, 2016

UBS Group AG

Commission File Number: 1-36764

UBS AG

Commission File Number: 1-15060

(Registrants' Names)

Bahnhofstrasse 45, Zurich, Switzerland, and

Aeschenvorstadt 1, Basel, Switzerland

(Address of

principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20‑F or Form 40-F.

This Form 6-K consists of the 3Q16 UBS

Group AG (consolidated) regulatory information, published today by the

registrants, which appears immediately following this page.

UBS Group AG (consolidated) regulatory information

Third quarter 2016

This document includes the following disclosures in accordance with Pillar

III requirements, as outlined in the FINMA Circular 2008 / 22 “Disclosure

–Banks“: (i) BIS Basel III leverage ratio information, (ii) reconciliation of

the IFRS balance sheet to the balance sheet according to the regulatory scope

of consolidation and (iii) information about the composition of our capital.

®

Refer to our third quarter 2016 report for information on our Swiss

SRB leverage ratio as of 30 September 2016

®

Refer to “Basel III Pillar 3 First Half 2016 Report,” under “Pillar

3, SEC filings & other disclosures” at

www.ubs.com/investors

for more

information

®

Refer to the “UBS Group AG consolidated supplemental disclosures

required under Basel III Pillar 3 regulations” in the “Additional regulatory

information” section of our Annual Report 2015 for more information

BIS Basel III leverage ratio

The BIS leverage ratio is calculated

by dividing the period-end tier 1 capital by the period-end leverage ratio

denominator (LRD). The LRD consists of IFRS on-balance sheet assets and

off-balance sheet items. Derivative exposures are adjusted for a number of

items, including replacement value and eligible cash variation margin netting,

the current exposure method add-on and net notional amounts for written credit

derivatives. The LRD further includes an additional charge for counterparty

credit risk related to securities financing transactions. In addition, balance

sheet assets deducted from our tier 1 capital are excluded from LRD, resulting

in a difference between phase-in and fully applied LRD for deferred tax assets

(DTAs) and net defined benefit pension plan assets.

The

“Reconciliation of IFRS total assets to BIS Basel III total on-balance sheet

exposures excluding derivatives and securities financing transactions” table

below shows the difference between total IFRS assets per IFRS consolidation

scope and the BIS total on-balance sheet exposures, which are the starting

point for calculating the BIS LRD as shown in the “BIS Basel III leverage ratio

common disclosure” table on the next page. The difference is due to the

application of the regulatory scope of consolidation for the purpose of the BIS

calculation. In addition, carrying values for derivative financial instruments

and securities financing transactions are deducted from IFRS total assets. They

are measured differently under BIS leverage ratio rules and are therefore added

back in separate exposure line items in the “BIS Basel III leverage ratio

common disclosure” table on the next page.

®

Refer to our third

quarter 2016 report for information on our Swiss SRB leverage ratio as of 30

September 2016

®

Refer to the “UBS

Group AG consolidated supplemental disclosures required under Basel III Pillar

3 regulations” in the “Additional regulatory information” section of our

Annual Report 2015 for more information on the regulatory scope of

consolidation

BIS Basel III leverage ratio

As of 30

September 2016, our BIS Basel III leverage ratio was 4.4% on a fully applied

basis and 5.0% on a phase-in basis. The BIS Basel III LRD was CHF 877 billion

on a fully applied basis and CHF 882 billion on a phase-in basis.

®

Refer to our third

quarter 2016 report for information on our BIS Basel III leverage ratio

denominator movements

Differences between the Swiss SRB and

BIS frameworks

The LRD

is the same under Swiss SRB and BIS rules.

However, there

are differences in the capital numerator between the two frameworks. Under BIS

rules, only common equity tier 1 and additional tier 1 capital are included in

the numerator, whereas under Swiss SRB rules total capital is eligible.

Furthermore, the BIS capital framework does not include gone concern

requirements as defined by the revised Swiss SRB framework, under which,

subject to final agreement with FINMA, phase-out hybrid tier 1 capital is only

eligible to meet gone concern requirements and is not included in the capital

numerator for the purpose of leverage ratio calculation.

|

Reconciliation of IFRS total

assets to BIS Basel III total on-balance sheet exposures excluding

derivatives and securities financing transactions

|

|

CHF million

|

30.9.16

|

|

On-balance sheet exposures

|

|

|

IFRS total assets

|

935,206

|

|

Adjustment for investments in banking, financial, insurance or

commercial entities that are consolidated for accounting purposes but outside

the scope of regulatory consolidation

|

(15,543)

|

|

Adjustment for investments in banking, financial, insurance or

commercial entities that are outside the scope of consolidation for

accounting purposes but consolidated for regulatory purposes

|

0

|

|

Adjustment for fiduciary assets recognized on the balance sheet

pursuant to the operative accounting framework but excluded from the leverage

ratio exposure measure

|

0

|

|

Less carrying value of derivative financial instruments in IFRS

total assets¹

|

(179,052)

|

|

Less carrying value of securities financing transactions in IFRS

total assets²

|

(103,459)

|

|

Adjustments to accounting values

|

0

|

|

On-balance sheet items

excluding derivatives and securities financing transactions, but including

collateral

|

637,153

|

|

Asset amounts deducted in determining BIS Basel III tier 1

capital

|

(13,070)

|

|

Total on-balance sheet

exposures (excluding derivatives and securities financing transactions)

|

624,083

|

|

1 Consists of positive replacement values and cash collateral

receivables on derivative instruments in accordance with the regulatory scope

of consolidation. 2 Consists of cash collateral on securities borrowed,

reverse repurchase agreements, margin loans and prime brokerage receivables

related to securities financing transactions in accordance with the

regulatory scope of consolidation.

|

The naming

convention in the following table is based on BIS guidance and does not reflect

UBS naming conventions.

|

BIS Basel III leverage ratio

common disclosure

|

|

|

|

|

|

CHF million, except where

indicated

|

30.9.16

|

|

|

|

|

|

|

On-balance sheet exposures

|

|

|

1

|

On-balance sheet items excluding derivatives and SFTs¹, but

including collateral

|

637,153

|

|

2

|

(Asset amounts deducted in determining Basel III tier 1 capital)

|

(13,070)

|

|

3

|

Total on-balance sheet exposures

(excluding derivatives and SFTs¹)

|

624,083

|

|

|

|

|

|

|

Derivative exposures

|

|

|

4

|

Replacement cost associated with all derivatives transactions

(i.e., net of eligible cash variation margin)

|

48,412

|

|

5

|

Add-on amounts for PFE² associated with all derivatives

transactions

|

87,298

|

|

6

|

Gross-up for derivatives collateral provided where deducted from

the balance sheet assets pursuant to the operative accounting framework

|

0

|

|

7

|

(Deductions of receivables assets for cash variation margin

provided in derivatives transactions)

|

(13,911)

|

|

8

|

(Exempted CCP³ leg of client-cleared trade exposures)

|

(16,018)

|

|

9

|

Adjusted effective notional amount of all written credit

derivatives⁴

|

143,757

|

|

10

|

(Adjusted effective notional offsets and add-on deductions for

written credit derivatives)⁵

|

(140,098)

|

|

11

|

Total derivative exposures

|

109,440

|

|

|

|

|

|

|

Securities financing

transaction exposures

|

|

|

12

|

Gross SFT¹ assets (with no recognition of netting), after

adjusting for sale accounting transactions

|

176,975

|

|

13

|

(Netted amounts of cash payables and cash receivables of gross

SFT¹ assets)

|

(73,517)

|

|

14

|

CCR⁶ exposure for SFT¹ assets

|

8,729

|

|

15

|

Agent transaction exposures

|

0

|

|

16

|

Total securities financing

transaction exposures

|

112,187

|

|

|

|

|

|

|

Other off-balance sheet

exposures

|

|

|

17

|

Off-balance sheet exposure at gross notional amount

|

104,158

|

|

18

|

(Adjustments for conversion to credit equivalent amounts)

|

(68,152)

|

|

19

|

Total off-balance sheet

items

|

36,006

|

|

|

Total exposures (leverage

ratio denominator), phase-in

|

881,717

|

|

|

(Additional asset amounts deducted in determining Basel III tier

1 capital fully applied)

|

(4,404)

|

|

|

Total exposures (leverage

ratio denominator), fully applied

|

877,313

|

|

|

|

|

|

|

Capital and total exposures

(leverage ratio denominator), phase-in

|

|

|

20

|

Tier 1 capital

|

44,061

|

|

21

|

Total exposures (leverage ratio denominator)

|

881,717

|

|

|

Leverage ratio

|

|

|

22

|

Basel III leverage ratio

phase-in (%)

|

5.0

|

|

|

|

|

|

|

Capital and total exposures

(leverage ratio denominator), fully applied

|

|

|

20

|

Tier 1 capital

|

39,003

|

|

21

|

Total exposures (leverage ratio denominator)

|

877,313

|

|

|

Leverage ratio

|

|

|

22

|

Basel III leverage ratio

fully applied (%)

|

4.4

|

|

1 Securities financing transactions. 2 Potential future

exposure – Current exposure method (CEM) add-on based on notional amounts.

3 Central cleared counterparties. 4 Includes protection sold, including

agency transactions. 5 Protection sold can be offset with protection

bought on the same underlying reference entity, provided that the conditions

according to the Basel III leverage ratio framework and disclosure

requirements are met. 6 Counterparty credit risk.

|

The naming

convention in the following table is based on BIS guidance and does not reflect

UBS naming conventions.

|

BIS Basel III leverage ratio

summary comparison

|

|

CHF million

|

30.9.16

|

|

1

|

Total consolidated assets as per published financial statements

|

935,206

|

|

2

|

Adjustment for investments in banking, financial, insurance or

commercial entities that are consolidated for accounting purposes but outside

the scope of regulatory consolidation¹

|

(28,613)

|

|

3

|

Adjustment for fiduciary assets recognised on the balance sheet

pursuant to the operative accounting framework but excluded from the leverage

ratio exposure measure

|

0

|

|

4

|

Adjustments for derivative financial instruments

|

(69,611)

|

|

5

|

Adjustment for securities financing transactions (i.e., repos

and similar secured lending)

|

8,729

|

|

6

|

Adjustment for off-balance sheet items (i.e., conversion to

credit equivalent amounts of off-balance sheet exposures)

|

36,006

|

|

7

|

Other adjustments

|

0

|

|

8

|

Leverage ratio exposure

(leverage ratio denominator), phase-in

|

881,717

|

|

1 This item includes assets that are deducted from tier 1

capital.

|

|

BIS Basel III leverage ratio

|

|

|

|

|

|

CHF million, except where

indicated

|

|

Phase-in

|

30.9.16

|

30.6.16

|

31.3.16

|

31.12.15

|

|

Total tier 1 capital

|

44,061

|

42,934

|

43,541

|

44,559

|

|

BIS total exposures (leverage ratio denominator)

|

881,717

|

902,431

|

910,000

|

904,014

|

|

BIS Basel III leverage ratio (%)

|

5.0

|

4.8

|

4.8

|

4.9

|

|

|

|

|

|

|

|

Fully applied

|

30.9.16

|

30.6.16

|

31.3.16

|

31.12.15

|

|

Total tier 1 capital

|

39,003

|

38,049

|

37,438

|

36,198

|

|

BIS total exposures (leverage ratio denominator)

|

877,313

|

898,195

|

905,801

|

897,607

|

|

BIS Basel III leverage ratio (%)

|

4.4

|

4.2

|

4.1

|

4.0

|

BIS regulatory key figures (phase-in)

The table below provides an overview

of our regulatory key figures as defined by BIS and FINMA as of 30 September

2016.

|

BIS regulatory key figures

|

|

CHF million, except where

indicated

|

|

30.9.16

|

|

|

|

|

|

Capital information

|

|

|

|

Eligible capital

|

|

55,576

|

|

of which: common equity tier

1 capital

|

|

37,207

|

|

of which: tier 1 capital

|

|

44,061

|

|

Risk-weighted assets

|

|

219,876

|

|

|

|

|

|

Capital ratios

|

|

|

|

Common equity tier 1 capital ratio (%)

|

|

16.9

|

|

Tier 1 capital ratio (%)

|

|

20.0

|

|

Total capital ratio (%)

|

|

25.3

|

|

|

|

|

|

Leverage ratio

|

|

|

|

Leverage ratio denominator

|

|

881,717

|

|

Leverage ratio (%)

|

|

5.0

|

Balance sheet reconciliation and

composition of capital

Reconciliation

of accounting balance sheet to balance sheet under the regulatory scope of

consolidation

The table below provides a

reconciliation of the IFRS balance sheet to the balance sheet according to the

regulatory scope of consolidation as defined by BIS and FINMA. Lines in the

balance sheet under the regulatory scope of consolidation are expanded and

referenced, where relevant, to display all components that are used in the

“Composition of capital” table.

|

As of 30.9.16

|

Balance sheet in accordance with IFRS scope of consolidation

|

Effect of deconsolidated entities for regulatory consolidation

|

Effect of additional consolidated entities for regulatory consolidation

|

Balance sheet in accordance with regulatory scope of

consolidation

|

References¹

|

|

CHF million

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

Cash and balances with central banks

|

94,680

|

|

|

94,680

|

|

|

Due from banks

|

15,120

|

(308)

|

|

14,811

|

|

|

Loans

|

305,021

|

93

|

|

305,114

|

|

|

Cash collateral on securities borrowed

|

18,277

|

|

|

18,277

|

|

|

Reverse repurchase agreements

|

69,999

|

|

|

69,999

|

|

|

Trading portfolio assets

|

105,437

|

(15,173)

|

|

90,264

|

|

|

Positive replacement values

|

154,383

|

25

|

|

154,407

|

|

|

Cash collateral receivables on derivative instruments

|

24,644

|

|

|

24,644

|

|

|

Financial assets designated at fair value

|

69,832

|

|

|

69,832

|

|

|

Financial assets available for sale

|

13,554

|

(32)

|

|

13,522

|

|

|

Financial assets held to maturity

|

7,005

|

|

|

7,005

|

|

|

Consolidated participations

|

0

|

116

|

|

116

|

|

|

Investments in associates

|

947

|

|

|

947

|

|

|

of which: goodwill

|

340

|

|

|

340

|

4

|

|

Property, equipment and software

|

8,113

|

(71)

|

|

8,042

|

|

|

Goodwill and intangible assets

|

6,345

|

|

|

6,345

|

|

|

of which: goodwill

|

6,087

|

|

|

6,087

|

4

|

|

of which: intangible assets

|

258

|

|

|

258

|

5

|

|

Deferred tax assets

|

12,396

|

(1)

|

|

12,395

|

|

|

of which: deferred tax

assets recognized for tax loss carry-forwards

|

7,315

|

(1)

|

|

7,314

|

9

|

|

of which: deferred tax

assets on temporary differences

|

5,081

|

|

|

5,081

|

12

|

|

Other assets

|

29,454

|

(191)

|

|

29,263

|

|

|

of which: net defined

benefit pension and other post-employment assets

|

359

|

|

|

359

|

10

|

|

Total assets

|

935,206

|

(15,543)

|

0

|

919,663

|

|

Reconciliation

of accounting balance sheet to balance sheet under the regulatory scope of

consolidation

(

continued)

|

As of 30.9.16

|

Balance sheet in accordance with IFRS scope of consolidation

|

Effect of deconsolidated entities for regulatory consolidation

|

Effect of additional consolidated entities for regulatory

consolidation

|

Balance sheet in accordance with regulatory scope of

consolidation

|

References¹

|

|

CHF million

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

|

Due to banks

|

11,227

|

(53)

|

|

11,174

|

|

|

Due to customers

|

411,840

|

(222)

|

|

411,618

|

|

|

Cash collateral on securities lent

|

3,726

|

|

|

3,726

|

|

|

Repurchase agreements

|

9,342

|

|

|

9,342

|

|

|

Trading portfolio liabilities

|

32,069

|

|

|

32,069

|

|

|

Negative replacement values

|

151,031

|

2

|

|

151,032

|

|

|

Cash collateral payables on derivative instruments

|

33,641

|

|

|

33,641

|

|

|

Financial liabilities designated at fair value

|

54,229

|

|

|

54,229

|

|

|

Debt issued

|

106,940

|

(15)

|

|

106,925

|

|

|

of which: amount eligible

for high-trigger loss-absorbing additional tier 1 capital²

|

5,388

|

|

|

5,388

|

13

|

|

of which: amount eligible

for low-trigger loss-absorbing additional tier 1 capital²

|

2,392

|

|

|

2,392

|

13

|

|

of which: amount eligible

for low-trigger loss-absorbing tier 2 capital³

|

10,332

|

|

|

10,332

|

7

|

|

of which: amount eligible

for capital instruments subject to phase-out from tier 2 capital⁴

|

714

|

|

|

714

|

8

|

|

Provisions

|

3,954

|

|

|

3,954

|

|

|

Other liabilities

|

63,216

|

(15,127)

|

|

48,090

|

|

|

of which: amount eligible

for high-trigger loss-absorbing capital (Deferred Contingent Capital Plan

(DCCP))⁵

|

730

|

|

|

730

|

13

|

|

Total liabilities

|

881,213

|

(15,415)

|

0

|

865,798

|

|

|

Equity

|

|

|

|

|

|

|

Share capital

|

385

|

|

|

385

|

1

|

|

Share premium

|

28,058

|

|

|

28,058

|

1

|

|

Treasury shares

|

(2,291)

|

|

|

(2,291)

|

3

|

|

Retained earnings

|

31,308

|

(262)

|

|

31,045

|

2

|

|

Other comprehensive income recognized directly in equity, net of

tax

|

(4,160)

|

133

|

|

(4,027)

|

3

|

|

of which: unrealized gains /

(losses) from cash flow hedges

|

2,005

|

|

|

2,005

|

11

|

|

Equity attributable to UBS

Group AG shareholders

|

53,300

|

(129)

|

0

|

53,171

|

|

|

Equity attributable to non-controlling interests

|

693

|

1

|

|

694

|

6

|

|

Total equity

|

53,993

|

(128)

|

0

|

53,865

|

|

|

Total liabilities and equity

|

935,206

|

(15,543)

|

0

|

919,663

|

|

|

1 References link the lines of this table to the respective

reference numbers provided in the "References" column in the

"Composition of capital" table. 2 Represents IFRS book value.

3 IFRS book value is CHF 10,356 million. 4 IFRS book value is CHF 1,090

million. 5 IFRS book value is CHF 1,527 million. Refer to the

"Compensation" section of our Annual Report 2015 for more

information on DCCP.

|

The tables below and on

the next pages provides the Composition of capital as defined by the Basel

Committee on Banking Supervision (BCBS) and FINMA. The naming convention does

not always reflect the UBS naming convention. Reference is made to items

reconciling to the balance sheet under the regulatory scope of consolidation as

disclosed in the table “Reconciliation of accounting balance sheet to balance

sheet under the regulatory scope of consolidation.” Where relevant, the effect

of phase-in arrangements is disclosed, as well.

Differences between the Swiss SRB and

BIS frameworks

The two frameworks

differ in their treatment of two tier 2 capital items. The amount of tier 2

high-trigger loss-absorbing capital in the form of Deferred Contingent Capital

plan awards granted for the performance years 2012 and 2013 is higher under

Swiss SRB rules than under BIS rules, because a different amortization is applied.

Moreover, a portion of unrealized gains on financial assets available for sale is

recognized as tier 2 capital under BIS rules, but not under Swiss SRB rules.

The BIS capital framework does not include

gone concern requirements as defined by the revised Swiss SRB framework. Under Swiss

SRB rules, certain senior unsecured debt, phase-out hybrid tier 1 and phase-out

tier 2 capital instruments are eligible to meet gone concern requirements. The

treatment of phase-out instruments is subject to final agreement with FINMA. The

implementation of the revised Swiss SRB framework resulted in additional minor

differences, due to the amortization required for gone concern instruments.

®

Refer to “Bondholder information” at

www.ubs.com/investors

for more information on the capital instruments, including key

features and terms and conditions of UBS Group AG and UBS AG on a consolidated

and on a standalone basis

®

Refer to “UBS Switzerland AG (standalone) regulatory information,” in

“Disclosure for legal entities” at

www.ubs.com/

investors

, for more information on the capital instruments

of UBS Switzerland AG

|

As of 30.9.16

|

Numbers phase-in

|

Effect of the

transition phase

|

References¹

|

|

CHF million, except where

indicated

|

|

|

|

|

1

|

Directly issued qualifying common share (and equivalent for

non-joint stock companies) capital plus related stock

surplus

|

28,443

|

|

1

|

|

2

|

Retained earnings

|

31,045

|

|

2

|

|

3

|

Accumulated other comprehensive income (and other

reserves)

|

(6,318)

|

|

3

|

|

4

|

Directly issued capital subject to phase-out from common equity

tier 1 capital (only applicable to non-joint stock

companies)

|

|

|

|

|

5

|

Common share capital issued by subsidiaries and held by third

parties (amount allowed in Group common equity tier 1 capital)

|

|

|

|

|

6

|

Common equity tier 1 capital

before regulatory adjustments

|

53,171

|

|

|

|

7

|

Prudential valuation

adjustments

|

(89)

|

|

|

|

8

|

Goodwill, net of tax, less additional tier 1 capital²

|

(3,823)

|

(2,548)

|

4

|

|

9

|

Intangible assets, net of tax²

|

(253)

|

|

5

|

|

10

|

Deferred tax assets recognized for tax loss carry-forwards³

|

(4,650)

|

(3,100)

|

9

|

|

11

|

Unrealized (gains) / losses from cash flow hedges, net of tax

|

(2,005)

|

|

11

|

|

12

|

Expected losses on advanced internal ratings-based portfolio

less general provisions

|

(356)

|

|

|

|

13

|

Securitization gain on sale

|

|

|

|

|

14

|

Own credit related to financial liabilities designated at fair

value, net of tax, and replacement values

|

(333)

|

|

|

|

15

|

Defined benefit plans

|

(215)

|

(144)

|

10

|

|

16

|

Compensation and own shares-related capital components (not

recognized in net profit)

|

(1,404)

|

|

|

|

17

|

Reciprocal crossholdings in common equity

|

|

|

|

|

17a

|

Qualifying interest where a controlling influence is exercised together

with other owners (CET instruments)

|

|

|

|

|

17b

|

Consolidated investments (CET1 instruments)

|

|

|

|

|

18

|

Investments in the capital of banking, financial and insurance

entities that are outside the scope of regulatory

consolidation, net of eligible short positions, where the bank

does not own more than 10% of the issued share capital

(amount above 10% threshold)

|

|

|

|

|

19

|

Significant investments in the common stock of banking,

financial and insurance entities that are outside

the scope of regulatory consolidation, net of eligible short

positions (amount above 10% threshold)

|

|

|

|

|

20

|

Mortgage servicing rights (amount above 10% threshold)

|

|

|

|

|

21

|

Deferred tax assets arising from temporary differences (amount

above 10% threshold, net of related tax liability)⁴

|

(872)

|

(1,161)

|

12

|

|

22

|

Amount exceeding the 15% threshold

|

|

|

|

|

23

|

of which: significant

investments in the common stock of financials

|

|

|

|

|

24

|

of which: mortgage servicing

rights

|

|

|

|

|

25

|

of which: deferred tax

assets arising from temporary differences

|

|

|

|

Composition

of capital (continued)

|

As of 30.9.16

|

Numbers phase-in

|

Effect of the

transition phase

|

References¹

|

|

CHF million, except where

indicated

|

|

|

|

|

26

|

Expected losses on equity investments treated according to the

PD/LGD approach

|

|

|

|

|

26a

|

Other adjustments relating to the application of an

internationally accepted accounting standard

|

(351)

|

|

|

|

26b

|

Other deductions

|

(1,611)

|

|

13

|

|

27

|

Regulatory adjustments applied to common equity tier 1 due to

insufficient additional tier 1 and tier 2 to cover deductions

|

|

|

|

|

28

|

Total regulatory adjustments

to common equity tier 1

|

(15,964)

|

(6,953)

|

|

|

29

|

Common equity tier 1 capital

(CET1)

|

37,207

|

(6,953)

|

|

|

30

|

Directly issued qualifying additional tier 1 instruments plus

related stock surplus

|

8,749

|

|

|

|

31

|

of which: classified as

equity under applicable accounting standards

|

|

|

|

|

32

|

of which: classified as

liabilities under applicable accounting standards⁵

|

8,749

|

|

13

|

|

33

|

Directly issued capital instruments subject to phase-out from

additional tier 1

|

|

|

|

|

34

|

Additional tier 1 instruments (and CET1 instruments not included

in row 5) issued by subsidiaries and held

by third parties (amount allowed in Group additional tier 1)

|

654

|

(654)

|

6

|

|

35

|

of which: instruments issued

by subsidiaries subject to phase-out

|

654

|

(654)

|

|

|

36

|

Additional tier 1 capital

before regulatory adjustments

|

9,402

|

(654)

|

|

|

37

|

Investments in own additional tier 1 instruments

|

|

|

|

|

38

|

Reciprocal crossholdings in additional tier 1 instruments

|

|

|

|

|

38a

|

Qualifying interest where a controlling influence is exercised

together with other owner (AT1 instruments)

|

|

|

|

|

38b

|

Holdings in companies which are to be consolidated (additional

tier1 instruments)

|

|

|

|

|

39

|

Investments in the capital of banking, financial and insurance

entities that are outside the scope of regulatory consolidation, net of

eligible short positions, where the bank does not own more than 10% of the

issued common share capital of the entity amount above 10% threshold)

|

|

|

|

|

40

|

Significant investments in the capital of banking, financial and

insurance entities that are outside the scope of regulatory consolidation

(net of eligible short positions)

|

|

|

|

|

41

|

National specific regulatory adjustments

|

(2,548)

|

2,548

|

|

|

42

|

Regulatory adjustments applied to additional tier 1 due to

insufficient tier 2 to cover deductions

|

|

|

|

|

|

Tier 1 adjustments on impact

of transitional arrangements

|

(2,548)

|

2,548

|

|

|

|

of which: prudential

valuation adjustment

|

|

|

|

|

|

of which: own CET1

instruments

|

|

|

|

|

|

of which: goodwill net of

tax, offset against additional loss-absorbing tier 1 capital

|

(2,548)

|

2,548

|

|

|

|

of which: intangible assets

(net of related tax liabilities)

|

|

|

|

|

|

of which: gains from the calculation

of cash flow hedges

|

|

|

|

|

|

of which: IRB shortfall of

provisions to expected losses

|

|

|

|

|

|

of which: gains on sales

related to securitization transactions

|

|

|

|

|

|

of which: gains/losses in

connection with own credit risk

|

|

|

|

|

|

of which: investments

|

|

|

|

|

|

of which: expected loss

amount for equity exposures under the PD/LGD approach

|

|

|

|

|

|

of which: mortgage servicing

rights

|

|

|

|

|

42a

|

Excess of the adjustments which are allocated to the common

equity tier 1 capital

|

|

|

|

|

43

|

Total regulatory adjustments

to additional tier 1 capital

|

(2,548)

|

2,548

|

|

|

44

|

Additional tier 1 capital

(AT1)

|

6,854

|

1,895

|

|

|

45

|

Tier 1 capital (T1 = CET1 +

AT1)

|

44,061

|

(5,058)

|

|

|

46

|

Directly issued qualifying tier 2 instruments plus related stock

surplus⁶

|

10,813

|

|

7

|

|

47

|

Directly issued capital instruments subject to phase-out from

tier 2⁶

|

731

|

(731)

|

8

|

|

48

|

Tier 2 instruments (and CET1 and additional tier 1 instruments

not included in rows 5 or 34) issued by subsidiaries and held by third

parties (amount allowed in Group tier 2)

|

|

|

|

|

49

|

of which: instruments issued

by subsidiaries subject to phase-out

|

|

|

|

|

50

|

Provisions

|

|

|

|

|

51

|

Tier 2 capital before

regulatory adjustments

|

11,544

|

(731)

|

|

Composition

of capital (continued)

|

As of 30.9.16

|

Numbers phase-in

|

Effect of the

transition phase

|

References¹

|

|

CHF million, except where

indicated

|

|

|

|

|

52

|

Investments in own tier 2 instruments⁶

|

(29)

|

17

|

7, 8

|

|

53

|

Reciprocal cross holdings in tier 2 instruments

|

|

|

|

|

53a

|

Qualifying interest where a controlling influence is exercised

together with other owner (tier 2 instruments)

|

|

|

|

|

53b

|

Investments to be consolidated (tier 2 instruments)

|

|

|

|

|

54

|

Investments in the capital of banking, financial and insurance

entities that are outside the scope of regulatory consolidation, net of

eligible short positions, where the bank does not own more than 10% of the

issued common share capital of the entity (amount above the 10% threshold)

|

|

|

|

|

55

|

Significant investments in the capital banking, financial and insurance

entities that are outside the scope of regulatory consolidation (net of

eligible short positions)

|

|

|

|

|

56

|

National specific regulatory adjustments

|

|

|

|

|

56a

|

Excess of the adjustments which are allocated to the additional

tier 1 capital

|

|

|

|

|

57

|

Total regulatory adjustments

to tier 2 capital

|

(29)

|

17

|

|

|

58

|

Tier 2 capital (T2)

|

11,515

|

(714)

|

|

|

|

of which: high-trigger

loss-absorbing capital⁵

|

269

|

|

13

|

|

|

of which: low-trigger

loss-absorbing capital⁶

|

10,332

|

|

7

|

|

59

|

Total capital (TC = T1 + T2)

|

55,576

|

(5,772)

|

|

|

|

Amount with risk weight pursuant to the transitional arrangement

(phase-in)

|

|

(3,046)

|

|

|

|

of which: net defined

benefit pension assets

|

|

(144)

|

|

|

|

of which: DTA on temporary

differences

|

|

(2,902)

|

|

|

60

|

Total risk-weighted assets

|

219,876

|

(3,046)

|

|

|

|

Capital ratios and buffers

|

|

|

|

|

61

|

Common equity tier 1 (as a percentage of risk-weighted assets)

|

16.9

|

|

|

|

62

|

Tier 1 (pos 45 as a percentage of risk-weighted assets)

|

20.0

|

|

|

|

63

|

Total capital (pos 59 as a percentage of risk-weighted assets)

|

25.3

|

|

|

|

64

|

CET1 requirement (base capital, buffer capital and

countercyclical buffer requirements) plus G-SIB buffer requirement, expressed

as a percentage of risk-weighted assets⁷

|

5.6

|

|

|

|

65

|

of which: capital buffer

requirement

|

0.6

|

|

|

|

66

|

of which: bank-specific countercyclical

buffer requirement

|

0.2

|

|

|

|

67

|

of which: G-SIB buffer

requirement

|

0.3

|

|

|

|

68

|

Common equity tier 1 available to meet buffers (as a percentage

of risk-weighted assets)

|

16.9

|

|

|

|

68a–f

|

Not applicable for systemically relevant banks according to FINMA

RS 11/2

|

|

|

|

|

72

|

Non-significant investments in the capital of other financials

|

1,504

|

|

|

|

73

|

Significant investments in the common stock of financials

|

769

|

|

|

|

74

|

Mortgage servicing rights (net of related tax liability)

|

|

|

|

|

75

|

Deferred tax assets arising from temporary differences (net of

related tax liability)

|

5,262

|

|

|

|

|

Applicable caps on the

inclusion of provisions in tier 2

|

|

|

|

|

76

|

Provisions eligible for inclusion in tier 2 in respect of

exposures subject to standardized approach (prior to application of cap)

|

|

|

|

|

77

|

Cap on inclusion of provisions in tier 2 under standardized

approach

|

|

|

|

|

78

|

Provisions eligible for inclusion in tier 2 in respect of

exposures subject to internal ratings-based approach (prior to application of

cap)

|

|

|

|

|

79

|

Cap for inclusion of provisions in tier 2 under internal

ratings-based approach

|

|

|

|

|

1 References link the lines of this table to the respective

reference numbers provided in the column “References” in the table

“Reconciliation of accounting balance sheet to balance sheet under the

regulatory scope of consolidation". 2 The CHF 6,371 million (CHF 3,823

million and CHF 2,548 million) reported in line 8 includes goodwill on

investments in associates of CHF 340 million and DTL on goodwill of CHF 56

million. The CHF 253 million reported in line 9 includes DTL on intangible

assets of CHF 5 million. 3 The CHF 7,750 million (CHF 4,650 million and

CHF 3,100 million) deferred tax assets recognized for tax loss carry-forwards

reported in line 10 differ from the CHF 7,314 million deferred tax assets

shown in line "Deferred tax assets" in the table “Reconciliation of

accounting balance sheet to balance sheet under the regulatory scope of

consolidation" because the latter figure is shown after the offset of

deferred tax liabilities for cash flow hedge gains (CHF 360 million) and

other temporary differences, which are adjusted out in line 11 and other

lines of this table respectively. 4 The CHF 2,033 million (CHF 872 million

and CHF 1,161 million) deferred tax assets arising from temporary differences

in line 21 differ from the CHF 5,081 million deferred tax assets on temporary

differences shown in the line “Deferred tax assets” in the table

“Reconciliation of accounting balance sheet to balance sheet under the

regulatory scope of consolidation" as the former relates only to the

amount above the 10% threshold. 5 CHF 8,749 million and CHF 269 million

reported in line 32 and 58 respectively of this table, includes the following

positions: CHF 5,388 million and CHF 2,392 million recognized in line

"Debt issued" in the table “Reconciliation of accounting balance

sheet to balance sheet under the regulatory scope of consolidation", CHF

730 million DCCP recognized in line "Other liabilities" in the

table “Reconciliation of accounting balance sheet to balance sheet under the

regulatory scope of consolidation" and CHF 508 million recognized in

DCCP-related charge for regulatory capital purpose in line 16

"Compensation and own shares-related capital components (not recognized

in net profit)" of this table. 6 The CHF 11,544 million in line 51

includes CHF 10,332 million low-trigger loss-absorbing tier 2 capital

recognized in line "Debt issued" in the table “Reconciliation of

accounting balance sheet to balance sheet under the regulatory scope of consolidation",

which is shown net of CHF 12 million investments in own tier 2 instruments

reported in line 52 of this table, CHF 714 million phase-out capital

recognized in line "Debt issued" in the table “Reconciliation of

accounting balance sheet to balance sheet under the regulatory scope of

consolidation", which is shown net of CHF 17 million investments in own

tier 2 reported in line 52 of this table, high-trigger loss-absorbing capital

of CHF 269 million reported in line 58 and CHF 200 million of unrealized

gains on financial assets available for sale, which are eligible under BIS

rules. 7 BCBS requirements are exceeded by our Swiss SRB requirements.

Refer to the UBS Group third quarter 2016 report, available under

"Quarterly reporting" at www.ubs.com/investors for more information

on the Swiss SRB requirements.

|

Notice to investors |

This document

and the information contained herein are provided solely for information

purposes, and are not to be construed as solicitation of an offer to buy or

sell any securities or other financial instruments in Switzerland, the United

States or any other jurisdiction. No investment decision relating to securities

of or relating to UBS Group AG, UBS AG or their affiliates should be made on

the basis of this document. Refer to UBS’s third quarter 2016 report and its

Annual Report 2015 for additional information. These reports are available at

www.ubs.com/investors.

Rounding |

Numbers presented

throughout this document may not add up precisely to the totals provided in the

tables and text. Percentages, percent changes and absolute variances are calculated

on the basis of rounded figures displayed in the tables and text and may not

precisely reflect the percentages, percent changes and absolute variances that

would be derived based on figures that are not rounded.

Tables |

Within tables, blank fields

generally indicate that the field is not applicable or not meaningful, or that

information is not available as of the relevant date or for the relevant

period. Zero values generally indicate that the respective figure is zero on an

actual or rounded basis. Percentage changes are presented as a mathematical

calculation of the change between periods.

This Form 6-K is

hereby incorporated by reference into (1) each of the registration statements

of UBS AG on Form F-3 (Registration Number 333-204908) and of UBS Group AG on

Form S-8 (Registration Numbers 333-200634; 333-200635; 333-200641; and

333-200665), and into each prospectus outstanding under any of the foregoing

registration statements, (2) any outstanding offering circular or similar

document issued or authorized by UBS AG that incorporates by reference any Form

6-K’s of UBS AG that are incorporated into its registration statements filed

with the SEC, and (3) the base prospectus of Corporate Asset Backed Corporation

(“CABCO”) dated June 23, 2004 (Registration Number 333-111572), the Form 8-K of

CABCO filed and dated June 23, 2004 (SEC File Number 001-13444), and the

Prospectus Supplements relating to the CABCO Series 2004-101 Trust dated May

10, 2004 and May 17, 2004 (Registration Number 033-91744 and 033-91744-05).

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned, thereunto duly authorized.

UBS Group AG

By:

_/s/ David Kelly_____________

Name: David Kelly

Title: Managing Director

By:

_/s/ Sarah M. Starkweather

_____

Name: Sarah M. Starkweather

Title: Executive Director

UBS AG

By:

_/s/ David Kelly_____________

Name: David Kelly

Title: Managing Director

By:

_/s/ Sarah M. Starkweather ____

Name: Sarah M. Starkweather

Title: Executive Director

Date: October 28, 2016

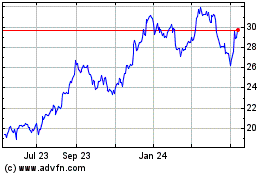

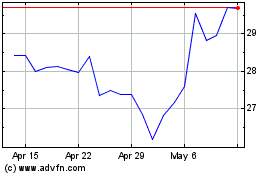

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024